MiQ Australia has found marketers need to evolve their campaign planning to effectively engage with consumers.

Shopping behaviour has changed since the onset of the pandemic with almost nine in 10 consumers going hybrid, or omnichannel, and Australia, along with the UK and China, are leading the charge, according to the MiQ Australia study.

Spending is also set to increase with almost half (46%) of people globally looking to increase retail spending compared to 2021. In Australia, a third (34%) plan to spend more than last year.

The leading programmatic media partner for agencies and brands has released a new report, Unboxing the Global Retail Consumer, looking at how consumer shopping habits continue to evolve, how to elevate the consumer experience across the shopping journey, and how marketers can leverage the insights to be effective in their campaign planning.

The MiQ Australia report shows the COVID-19 pandemic has significantly altered the way people shop, with 87% of people globally admitting to now shopping hybrid, embracing a mix of online and bricks- and-mortar retail.

Alternate shopping extends to pre-purchase research, the report found, with one in three people almost always comparing and researching products online before buying with the majority using their smartphones for this purpose.

However, most will start their research journey online but make the final purchase in a store, naming “urgency” and the ability to “try before they buy” as the main reasons to head in-store.

While hybrid shopping remains popular, online shopping has significantly increased post- pandemic, with six in 10 people regularly shopping online.

In Australia, 44% of people say they now regularly shop online, with the most popular buying categories of essential items, beauty products and personal care, fashion, consumer electronics and entertainment, home improvement and kids and baby products and toys, albeit in smaller numbers than during the pandemic.

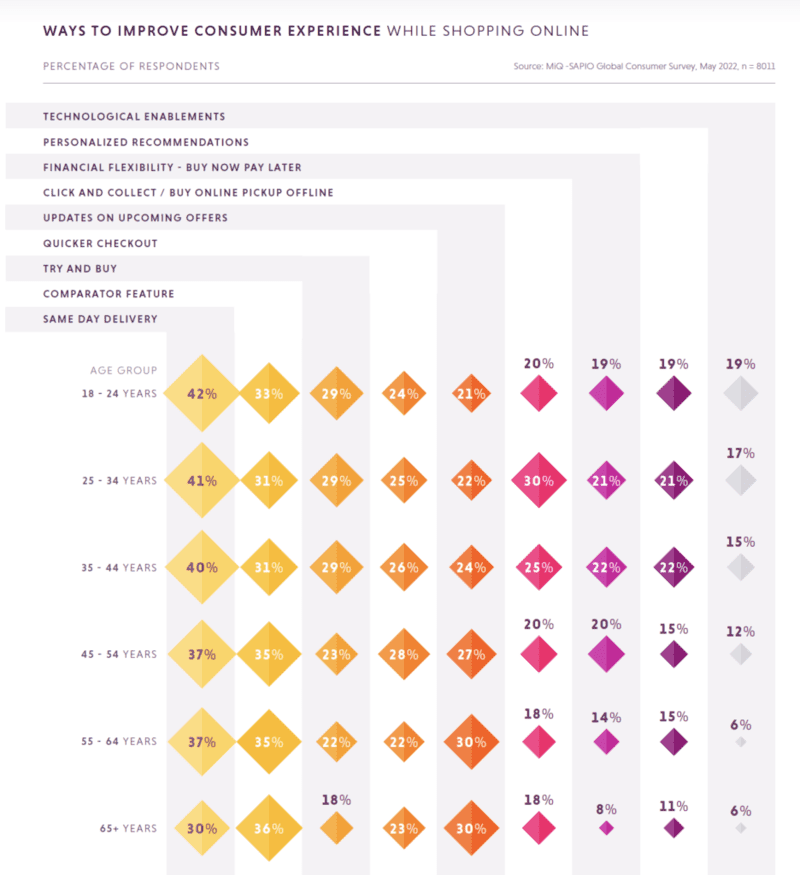

Given the predicted rise in shopping globally, elevating the customer experience will be top-of- mind for many brands, with major investment set for product development, feature enhancements, and cutting-edge technologies like AR/VR, and virtual shopping guides.

NFTs and web3 transactions look set to be commonplace in ecommerce in less than five years, especially with web3’s focus on blockchain concepts like decentralisation and token-based economies and the metaverse’s use of AR, VR, blockchain, crypto and social commerce.

It is also an opportunity for marketers to re-look at their campaign strategies, the report said, and how they can use complex data intelligence to better understand consumers and drive successful programmatic campaigns.

Jason Scott

MiQ APAC CEO, Jason Scott said personalised, omnichannel campaigns and planning for a presence in emerging technologies, that stand out from the crowd would be most successful with the new shopping cohort.

“Reaching the right audience across the right platform with the right messaging is the bare minimum that advertisers need to be able to do post-pandemic. Now, brands have to stand out by tailoring campaigns to user preferences. Think: ‘where should this ad go and what does it look like?’” he said.

“With nearly half the shoppers globally likely to spend more on retail purchases in 2022, compared to last year, it’s more important than ever for marketers to keep pace with the shopping evolution and ensure their campaigns are working effectively across multiple touchpoints to reach shoppers in the moment.”

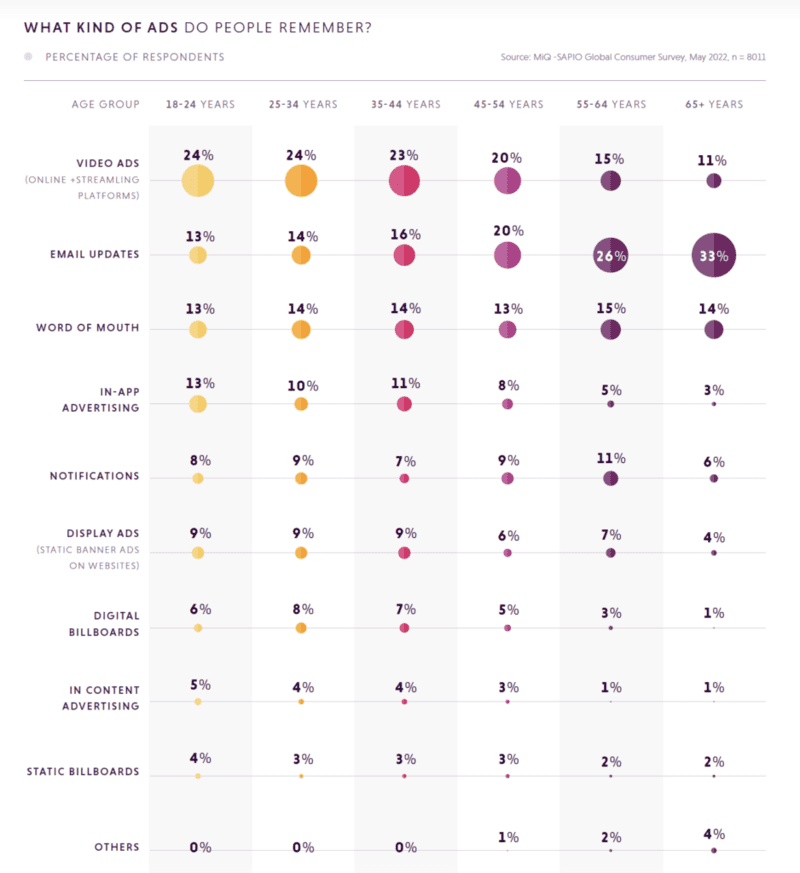

According to the MiQ Australia report, video advertising is the most memorable and grabs the most audience attention, particularly among millennials and Gen Z, but advertising on online platforms like mobile, desktop and tablet remains popular.

The report recommends a diversified, omnichannel strategy, to help mitigate risks caused by over-dependency across a single platform, while also establishing incremental reach in alternative segments. It also notes that marketers need to account for seasonal CPM variations, with high inventory demand inflating advertising costs by up to 30%.

“For marketers, success in the new shopping era will come down to making the most of retail opportunity, by knowing your audience, planning and connecting cross-media efforts,” Scott said.

“We know consumers are constantly evolving so it’s important for marketers to continually look at how their audiences are shopping, how they’re researching their buying, and how budgets have changed, to reach them effectively.

“Personalisation and high-impact creative that aligns with business goals will be key to maximising engagement and ROI, while cross-platform campaigns will also be key to exposure. Identify your audiences across different platforms and target them where it matters the most.

“Finally, be prepared to flex – with global events and costs continuing to affect the supply chain, marketing needs to be agile, and marketers need to plan for all possible situations to continually optimise campaign spending across the marketing mix,” Scott added.

Methodology: The data was sourced from digital devices including PCs, laptops, and viewing data from connected TVs with location data from mobile devices. User activities were compared from last year to determine how behaviour had changed. This data was then combined with critical insights from a survey of more than 8,000 consumers in Australia, North America, Europe, Southeast Asia, China, and the Middle East.