Global advertising revenues for media owners to reach $979 billion in 2025, up +4.9% in 2024.

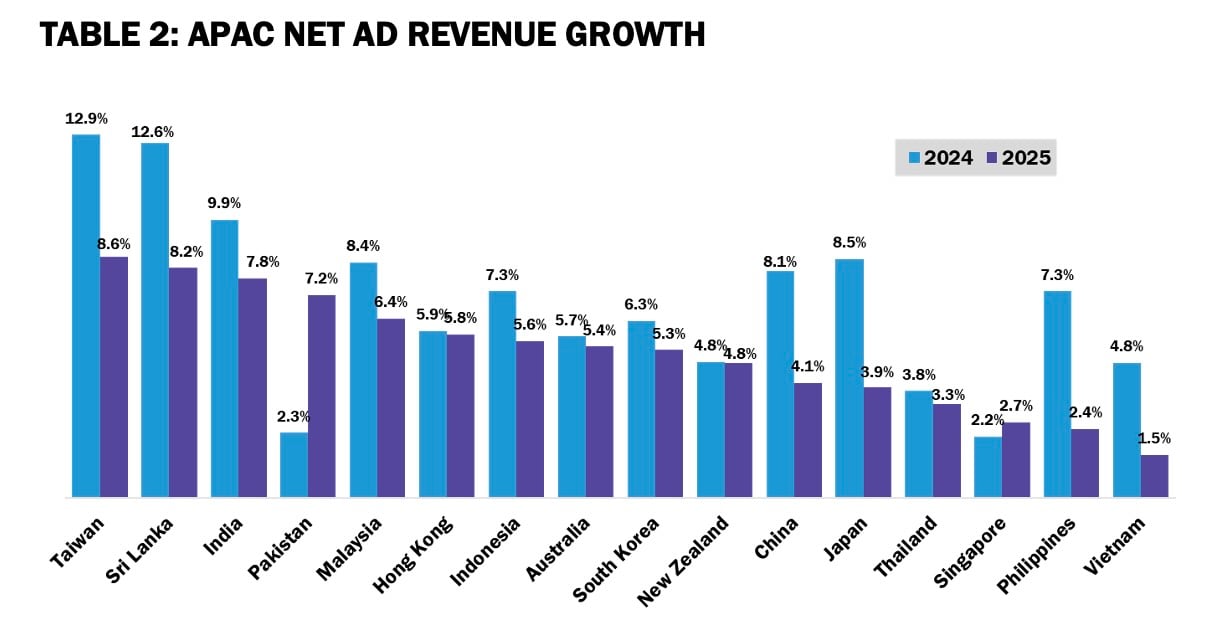

The results, from MAGNA’s Global Ad Forecast, also revealed the advertising economy in Asia Pacific region grew by +7.9% in 2024 to reach $288 billion amid a stable economic environment, with real GDP increasing by +5.3% in 2024.

Meanwhile, in Australia, the 2025 net ad revenue growth was forecast as 5.4%, slightly down 0.3 points from last year’s 5.7%.

Inflation in APAC has decline and the report noted that while some economies are still seeing sustained price pressures, others are facing deflationary risks.

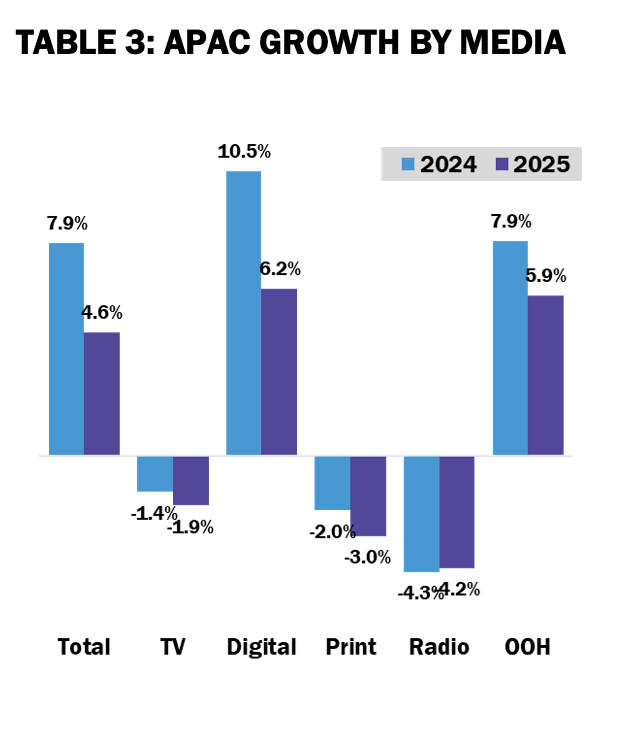

MAGNA noted that there is now the threat of trade wars and geopolitical uncertainty that is causing additional hesitation from brands, and as a result is one of the reasons why growth expectations in 2025 are significantly lower when it comes to ad spending (+4.6%, down from +7.9% growth in 2024).

MAGNA on traditional media

The report noted that overall APAC growth of +7.5% in 2024 consisted of traditional media owners seeing flat growth to reach $68 billion (24% of budgets), and digital pure player publishers seeing growth of +10.5% to reach $220 billion (76% of budgets).

Television budget dipped into the negative by 1.9%, while print was down -3.0% and radio to -4.2%.

MAGNA noted that while the increasing share of streaming revenues for TV broadcasters helps to cushion the declines in overall budgets, that cannot fully offset the trend of consumers shifting their attention from television to other formats. In 2024, TV spending was also buoyed by sporting events – primarily the Paris Olympics.

Digital and social media advertising

Like most regions, digital advertising revenues is the driver of growth in APAC with search at the top and representing represented $100 billion in 2024 and 46% of total digital advertising budgets, according to MAGNA’s findings.

Both search and social media revenues are driven by mobile devices. Smartphones are not just the dominant way that most consumers access the internet; in many APAC markets they are the only way consumers access the internet.

Search advertising in APAC is substantially driven by retail media platforms, especially in China where Alibaba, JD.com, Pinduoduo, and Meituan all drive search advertising revenues. Core search is also spiking around the world as traditional search platforms like Google and Baidu also see strong performance relative to recent results.

In 2025, MAGNA forecasts search advertising growth will slow to +5.3% because of uncertainty from businesses and consumers around financial visibility. But it will still have incremental $5bn+ of new budgets, trailing just social media for the largest portion of incremental spending.

Social media advertising had strong growth in 2024 at +16.3% and in 2025 is expected to grow by +9% in 2025, representing an incremental $7bn of new money in the APAC region.

The MAGNA report noted that many consumers skipped the desktop hardware generation and conduct their digital lives solely on their smartphones. Furthermore, in China consumers don’t just do shopping and communication on smartphones, but also banking, insurance, and many work functions.

The strongest growth in the APAC region was from Taiwan (+12.9%), Sri Lanka (+12.6%), and India (+9.9%). Weak advertising revenue growth, on the other hand, came from Singapore (+2.2%), Pakistan (+2.3%), and Thailand (+3.8%).

MAGNA forecasted that in APAC, by 2029, the share of total revenues that are represented by linear advertising formats will have fallen to just 18%, potentially representing $64 billion in contrast to the current share of $68 billion.

Meanwhile, Digital pure players, on the other hand, will represent 82% of total budgets and $294 billion, significantly higher than their 2024 total ($220 billion).

Ros Allison

“Some return to growth evident for the Australian market in 2025,” Ros Allison, Head of Product & Innovation, MAGNA Australia, said.

“Early recovery in H1 and strong market fundamentals despite some dark clouds of geopolitical upheaval and tariff uncertainty. Digital platforms dominate the Australian market, taking over three quarters of ad revenue. Renewed positivity for Traditional Media Owners – including their digital assets – with stabilisation of TV audiences, growth for streaming and podcasting, and a standout market for OOH vendors.”

Leigh Terry, CEO IPG Mediabrands APAC, said: “The continued resilience and dynamism of the APAC advertising economy in 2024, growing by nearly 8%, reinforces the region’s strategic importance for global brands. As digital platforms increasingly become the primary gateway to consumers, especially in mobile-first markets, advertisers must evolve their strategies to meet where attention is shifting.

“While the outlook for 2025 is tempered by macroeconomic and geopolitical uncertainty, the underlying fundamentals remain strong. APAC’s digital transformation is far from complete, and for brands willing to invest smartly, the region still offers outsized growth opportunities.”

Paul Waller, Chief Investment Officer IPG Mediabrands APAC, said: “With fewer cyclical events in 2025, the projected global growth of +4.9% in 2025 is still noteworthy. As MAGNA reports, digital continues to be the engine of expansion and in APAC will represent 82% of total budgets in by 2029.

“Powered by mobile-first consumers and retail media innovation, especially in China, strategic allocation to these dynamic channels will be critical for brands navigating future complexities, ensuring sustained ROI and market relevance in an increasingly digital first APAC.”

Top image: Ros Allison