GroupM has released its e-commerce and retail media forecast – This Year Next Year.

The forecast detailed the socioeconomic factors contributing to the state of this space which is set to reach $101 billion in annual revenue this year, an increase of 15% over 2021.

With the new data, GroupM’s report highlights the magnitude and rate of retail sales across the global markets, the rise of e-commerce and retail media solutions as international retailers, and the demands of consumers and advertisers.

GroupM’s analysis has found key findings:

• Global retail media is likely to reach $101 billion in 2022 (15% higher than a year ago) and will surpass $160 billion in annual revenue in five years’ time

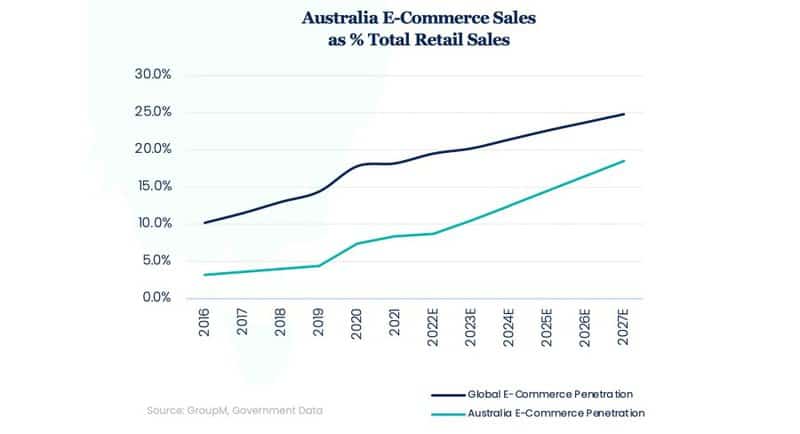

• We estimate global e-commerce to make up 19% of global retail sales in 2022, growing to 25% by 2027

• Retail media ad revenue represented 18% of global digital advertising revenue in 2021 and 11% of total global ad revenue

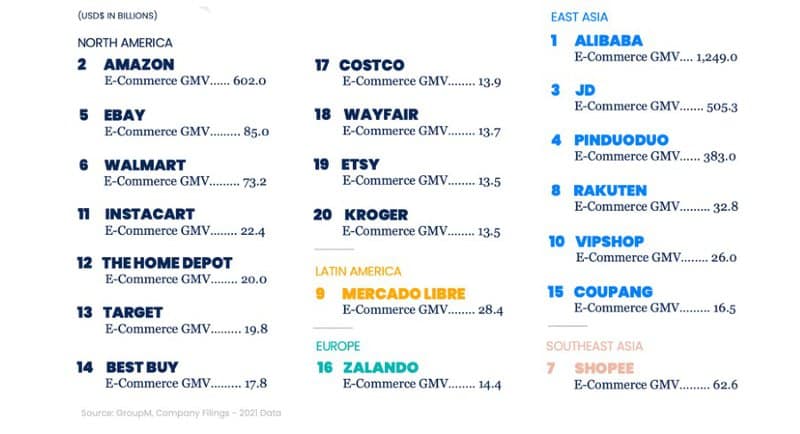

• Twenty of the top global e-commerce companies accounted for 67% of global e-commerce sales in 2021

• The estimated global e-commerce sales of $5.4 trillion dollars this year:

• China and the U.S. alone will make up 52% of that figure

• Nearly 61% of the total, $3.3 trillion, can be attributed to just seven markets: the U.S., China, Japan, Germany, the U.K., Canada and Australia

The state of retail and global e-commerce sales

The report looked into the state of retail sales and global e-commerce. During the pandemic, the ratio of “goods” and “sales” changed as most consumers we not spending on transport, travel, leisure and entertainment. Instead, people were spending on their home offices, electronics, and DIY home improvements.

Group M noted that in Australia, goods expenditure outpaced services expenditure since March 2020. At the same time, global advertising revenue recorded a 24% growth in 2021, in contrast to the 2020 figure, which was a 2% decline.

The report noted that the growth of retail sales, the shift to e-commerce sales and the condensed time frame of those changes contributed to the advertising intensity and revenue.

“Our research indicates higher advertising intensity for goods-and product- based companies versus services companies, helping illustrate why 2021 was such a banner year for advertising growth.”

GroupM’s model estimates global e-commerce sales of $5.4 trillion this year, with China and the U.S. making up 52% of that figure.

Meanwhile, 61%, or $3.3 trillion, can be attributed to the U.S., China, Japan, Germany, the U.K., Canada, and Australia. The report estimated that e-commerce sales will reach $9.1 trillion by 2027.

Group M predicts that e-commerce will represent 19% of global retail sales in 2022, up from 18% in 2021 and 2020, supported by $101 billion in retail media.

Top ranking e-commerce companies

The GroupM forecast also highlighted the top e-commerce companies, and coming out on top was Chinese company Alibaba which has more than double the gross merchandise value (USD$1,249 billion) of the second placer, American-run Amazon (USD$602 billion).

While the pandemic saw impressive growth figures in the e-commerce sector, GroupM estimated that that would “decelerate meaningfully in 2022” as offline activities return, supply chain shortages impact the availability of certain goods, and high inflation grips large economies.

The report also noted: “We also expect demand for some product categories, including electronics, fitness equipment, household goods and furniture, to soften after stimulus payments (in some countries) and new home-based work and life led to pandemic buying sprees.”

Trends in Australia

Looking at trends in Australia, GroupM said they estimate “Australia’s e-commerce market will grow by 8.4%, below last year’s growth of 24% as well as the pre-pandemic three-year CAGR (compound annual rate of growth) of 15%.”

The report estimated that total retail would amount to AUD$504 billion, with e-commerce accounting for 8.7% of the figure. By 2027, that figure will grow, with retail sales expected to reach AUD$602 billion, with 19% from e-commerce.

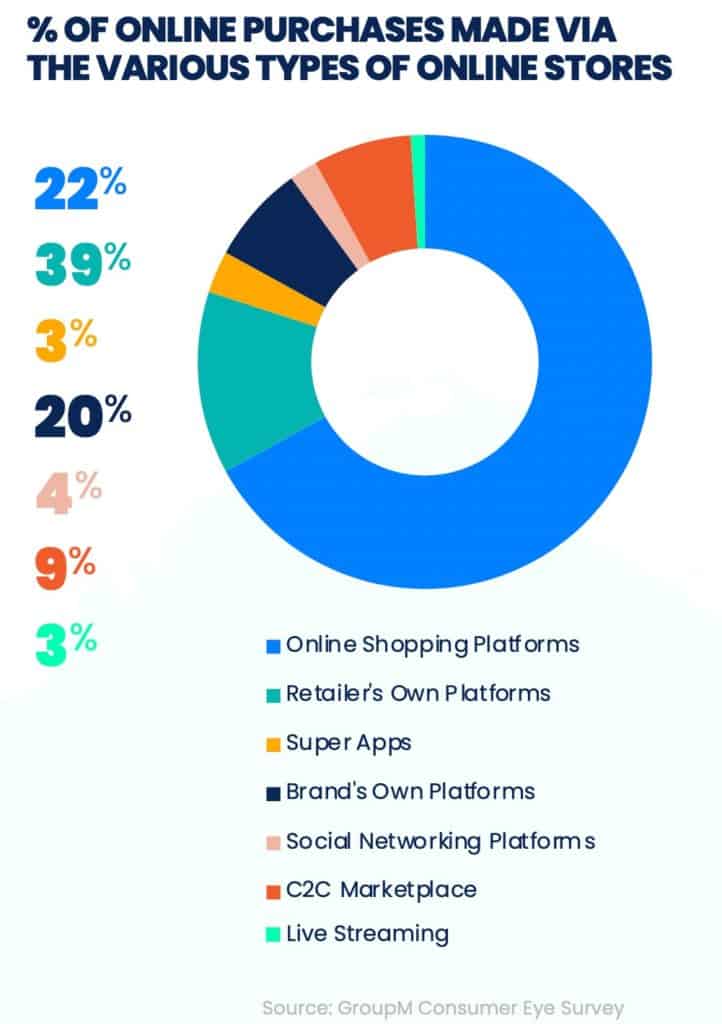

Purchase platforms taking the most significant share in Australia are retailer’s own shopping platforms at 39%, followed by online shopping platforms at 22% and a brand’s platform at 20%.

While retail has continued to grow, steep increases in housing and energy costs are, according to the report: “expected to weaken demand among consumers with low or marginal free monthly cash flow in the second half of the year.”

According to the report, retail e-commerce marketing leaders are firmly establishing themselves in Australia, which highlights good performers like eBay and Amazon.

Meanwhile, grocery and fashion categories are still seeing significant growth, with Coles and Woolworths reporting approximately 50% year-over-year growth in calendar Q1.

Sean Bone, GroupM Australia GM of Commerce, said: “Without the rocket-fuel of lockdowns driving both demand and investment, growth is increasingly driven by sticky value propositions and a focus on customer lifetime value.

“While the surge and high-growth or e-commerce in recent years saw businesses quickly pivot to adopt ecommerce at all costs, these changing market dynamics require a more savvy and nuanced approach to e-commerce growth in the future, and to meeting consumer needs through omnichannel strategies.

“The current cost of living crisis, may well impact consumer confidence, but is unlikely to impact the broader shifting of behaviours towards online. E-commerce now represents 9% of Australian retail sales, when we exclude food sales to provide an apples-with-apples view across markets,” he said.

Bone added: “That figure will double to 19% over the next five years. In turn, that market power will fuel the continued growth of Retail Media. There we see ongoing expansion of offerings and audiences, beyond their native platforms, as well as the entrance of new players providing healthy competition.”