As Foxtel today closes its streaming TV and movie business Presto, Foxtel has made a special offer to customers offering them a streaming “Pop pack” for just $15 a month which includes some of the most popular shows on the platform including Westworld, Game of Thrones, Wentworth and A Place To Call Home.

The offer, under the Foxtel Play brand, will rise to $35 after three months.

Coinciding with the close of Presto, Foxtel has also made the streaming service available to both Foxtel and Foxtel Play customers.

Meantime Roy Morgan has updated its estimates of the number of Netflix subscribers in Australia and revealed how much broadcast TV Netflix subscribers watch.

The highlights of both statements are published below.

Foxtel reveals new On Demand content for February

Foxtel customers will have instant access to some of the world’s greatest dramas in February as its new agreement with HBO brings a massive library of new releases and past hits including Big Little Lies and Girls. New movies available On Demand will include blockbusters Batman vs. Superman: Dawn of Justice and Captain America: Civil War.

All Foxtel residential customers with an internet-connected Foxtel iQ box can instantly stream any of Foxtel’s award-winning On Demand programming as well as record a huge amount of great programming to watch when it suits them. Foxtel Play, Foxtel’s streaming-only service, also allows access to world-class drama live and On Demand and is available from as little as $15 per month.

Both Foxtel residential and Foxtel Play customers have complimentary access to Foxtel’s companion streaming app, Foxtel Go, which enables them to stream TV live and On Demand to selected smartphones and tablets, where they want, when they want.

New content includes:

• HBO’s highly anticipated new miniseries Big Little Lies, based on Australian author Liane Moriarty’s bestselling book, begins in February and will add new episodes to Foxtel On Demand in line with the US broadcast. The seven-episode series follows three mothers of school kids as their seemingly perfect lives take a dark turn and unravel to the point of murder.

• The sixth (and final) season of HBO’s Girls also kicks off in February with new episodes available On Demand after each live broadcast. Seasons 1-5 are also available On Demand for fans and newcomers who want to follow the antics of Hannah, Shoshana, Marnie and Jessa as they navigate life in New York City.

Netflix subscribers still watch (some) commercial TV

One in four Australian homes now have a Netflix subscription, Roy Morgan’s latest data to the end of 2016 shows. An estimated 5,862,000 Australians aged 14+ (29.5%) now have access to the subscription video-on-demand (SVOD) service (via 2,268,000 household subscriptions).

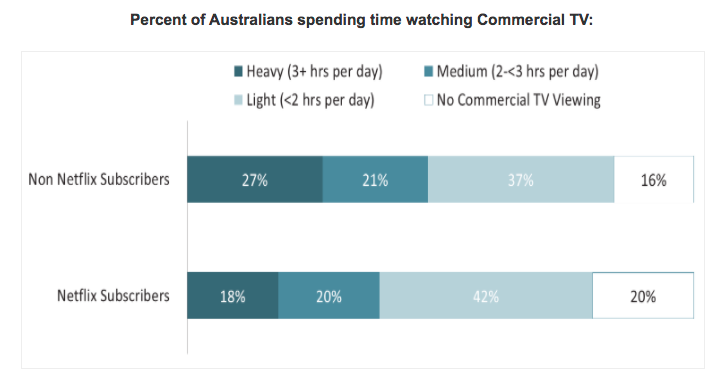

Netflix subscribers watch less commercial TV than others – but this is not simply because they now have SVOD in the home. Many subscribers were already watching less commercial TV, which was a driving reason to subscribe in the first place.

Among today’s Netflix subscribers, 18% still watch a heavy amount of commercial television (classified as more than three hours on a normal weekday), and another 20% watch a medium amount of two to three hours. 42% watch less than two hours’ worth, and the remaining 20% say they don’t watch any at all on a regular Monday to Friday.

Michele Levine, CEO – Roy Morgan Research, says:

“Netflix finished 2016 in almost 2.3 million Australian homes. Commercial TV networks (and their advertisers) are right to be concerned about the popularity of SVOD, and how much attention it will ‘steal’ from free-to-air television.

“Many Netflix subscribers, especially in the early days, weren’t big viewers of commercial TV – so the industry wasn’t necessarily losing audiences it had to begin with. Heavy commercial TV viewers remain the least likely to have Netflix – however subscriptions among this group have grown over 50% in 2016, faster than any other viewing segment.

“Free-to-air networks, industry bodies and advertisers must now pay closer attention to SVOD subscription rates and usage habits among their heaviest viewers.”