Australians are signed up to an average of eight loyalty programs but only actively use five, according to Honeycomb Strategy’s latest research into program success. The Science of Loyalty: From Situationship to Relationship study analysed 52 of the country’s leading programs across retail, travel, finance, and subscription models.

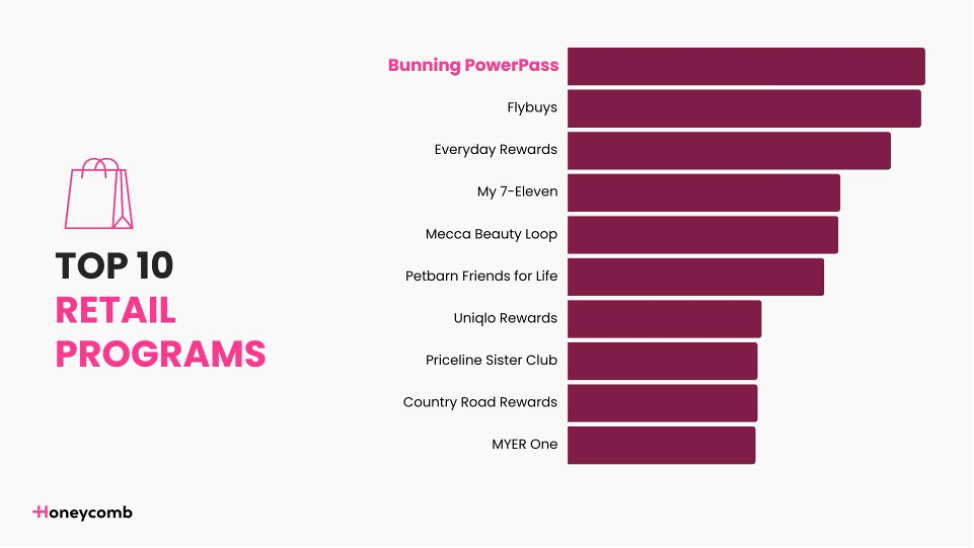

The study ranked programs on membership, engagement, and impact on spend, with the top performers including Bunnings PowerPass, Coles Plus, One Pass, Woolworths Delivery Unlimited, Costco Membership, FlyBuys, American Express Membership Rewards, eBay Plus, Telstra Plus, and Uber One.

Founder of Honeycomb Strategy, Renata Freund, said many programs struggle to convert sign-ups into meaningful customer relationships. “The truth is that a large portion of Australia’s loyalty programs are great at driving the initial sign-up with a motivating benefit, but very few are translating that into ongoing engagement that ladders up to meaningful ROI,” Freund said.

The full report is available on the Honeycomb Strategy website.

A loyalty market under pressure

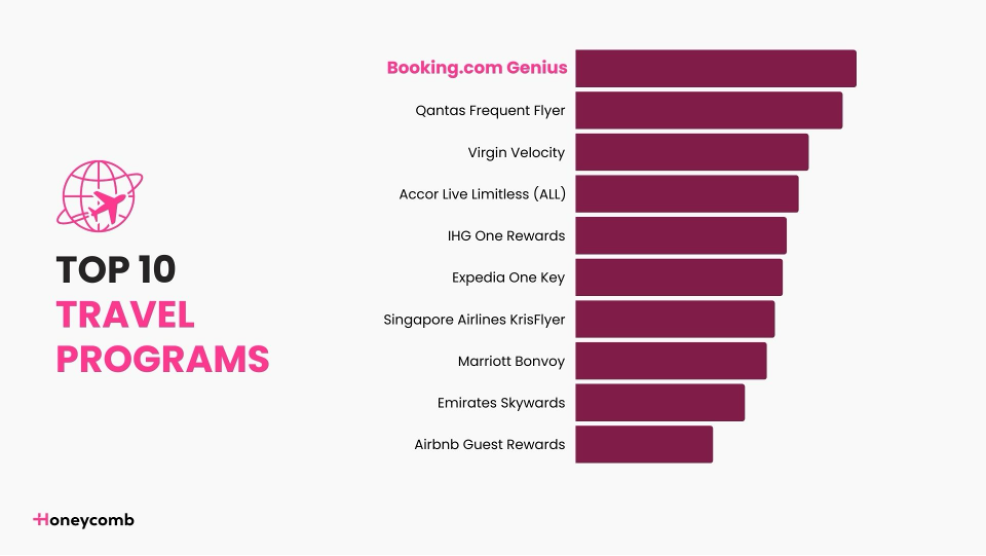

While Australians are experiencing a loyalty boom, with almost every major brand offering a program, high attrition rates remain a challenge. Emirates Skywards, Baby Bunting Family, Marriott Bonvoy, H&M Hello Member, and Club BCF were identified as the programs consumers were most likely to abandon.

The research also highlighted the growing influence of paid loyalty models. More than 70 per cent of Millennials and 65 per cent of Gen Zs now subscribe to paid programs, with the strongest performers being One Pass, Costco Membership, Coles Plus, eBay Plus, and Woolworths Delivery Unlimited.

Behavioural science at play

Honeycomb Strategy found the most successful programs leveraged behavioural science principles, including loss aversion, social identity, reciprocity, and cognitive ease, to drive long-term engagement.

“Seven in 10 consumers expect immediate benefits from their loyalty program, while 63 per cent quickly lose interest if the program doesn’t give them something new or valuable,” Freund said. “Brands are not just competing on benefits, they are competing for attention, and attention is scarce.”

The report concluded that loyalty programs focusing on frictionless engagement and habitual use were most likely to influence where consumers spend. It recommended that CMOs and insights leaders prioritise behavioural design over expanding benefit catalogues.