After years of circling the edges of global dealmaking, Australia has suddenly found itself in the middle of it.

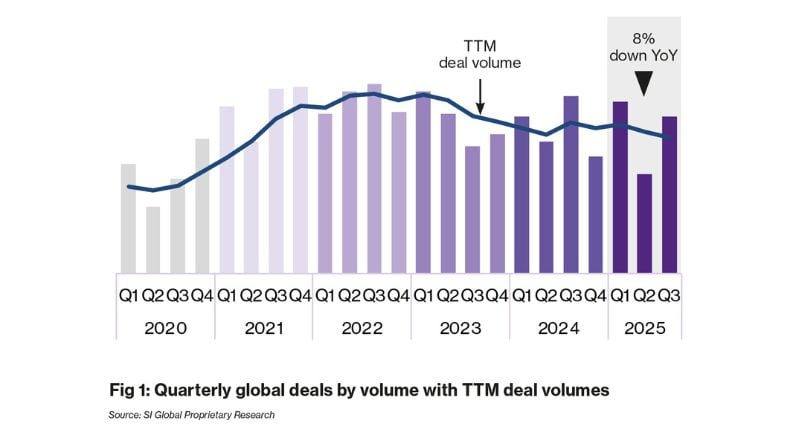

New data from SI Global shows the country is now driving momentum in marketing, tech and consultancy M&A, even as deal volumes slide across the US and Europe.

APAC grew three per cent while global activity fell eight per cent – a rebalancing that hints at something deeper than short-term opportunism.

The shift is structural. Strategic. And, according to SI Global leaders, long overdue.

Michael Chin, Director at SI Global, tells Mediaweek the acceleration is rooted in geography, economics and credibility.

“Australia is benefiting from being shielded from the larger geopolitical and macroeconomic issues that are slowing activity in the US and Europe,” he said, noting that many of those pressures “are long running cycles and Australia is removed from much of the volatility.”

Layered on top is a talent market global buyers trust. Chin describes it as: “exceptional talent depth and a strong reputation in the sectors global buyers care about.”

For international groups recalibrating their APAC exposure away from China, Australia has become the safe, scalable alternative. As Chin put it, buyers still want APAC, and “Australia stands out as the most stable and scalable option.”

Michael Chin, Director at SI Global

A market that’s no longer an afterthought

Julia Vargiu, Director, Australia at SI Global, said Australia’s moment isn’t a coincidence but a reflection of its fundamentals.

“Australia has been more resilient than the US and Europe because our fundamentals are strong,” she told Mediaweek.

The country’s digital maturity, early adoption of AI and deep independent agency ecosystem “gives buyers confidence,” particularly those hunting capability depth and leadership stability.

The psychological shift is perhaps the most telling. “We are no longer treated as an outpost,” Vargiu said.

“For global buyers, Australia has shifted from interesting to essential.” What was once a stepping stone has become “the strategic launch pad into what is becoming one of the most dynamic regions heading into 2026.”

This aligns with broader SI Global data showing global acquirers prioritising markets with AI-ready workflows, modernised tech stacks and the ability to scale. Australia now sits squarely in that intersection.

Julia Vargiu, Director, Australia at SI Global

Private equity drives the next wave

Private equity is powering much of the movement. SI Global’s report found that 80 per cent of its sell-side clients chose PE or PE-backed buyers over strategics last year. Chin says the appeal comes down to two things: flexibility and future upside.

“First is the appeal of the double exit,” he said.

Founders can de-risk now, then “realise a second exit at scale” by rolling equity into a broader platform. “Second is autonomy,” he added.

“Most PE backed platforms let founders keep running their business with far less interference than a strategic buyer.”

PE competition is intense, particularly for firms strong in data, AI, media and B2B. That competition, Chin said, “gives founders leverage.”

Vargiu said the founder mindset is evolving with the market.

“Founders are shifting their mindset,” she said. “They are less focused on a single exit and more focused on finding a true growth partner.”

Deals such as The Company We Keep’s sale to Opus Agency and Merchantwise’s acquisitions of Jaywing and Frank Digital illustrate the trend: founders staying in, building bigger, and using PE muscle to scale beyond what was possible independently.

AI becomes the new deal battleground

Australia’s early adoption of AI is also paying off in M&A terms.

Vargiu said “half of the buyers we surveyed have already embedded AI and machine learning into their M&A strategy,” and they now expect AI to be operationalised, not ornamental.

They want to see workflow automation, faster strategic output, data-led decisioning and human-plus models where AI enhances capability rather than replaces it.

Differentiation matters too. Buyers are now asking whether a company relies on off-the-shelf tools or whether unique IP, domain expertise or integrated processes create defensible value.

Chin pointed to a martech founder who told him their company now delivers “the same or more output with fewer people because of AI,” while maintaining value-based pricing.

The danger, he warned, lies with firms that “commoditise their service and it becomes a race to the bottom,” whereas the strongest “combine human expertise with AI in a way that lifts quality and personalisation.”

Accenture sets signals, not limits

Accenture continues to dominate global consultancy acquisitions, but Chin said its activity should be read as a signal, not a constraint.

“When Accenture buys in a category, it validates that capability,” he said. Rather than crowding out competitors, its buying “often cultivates more activity.”

Vargiu said it also highlights whitespace. Where Accenture isn’t buying, opportunity opens for other strategics and independents.

She added that deal structures vary widely, with Accenture favouring retention-led models while others pursue performance-based structures or equity rollover.

What founders must tighten before 2026

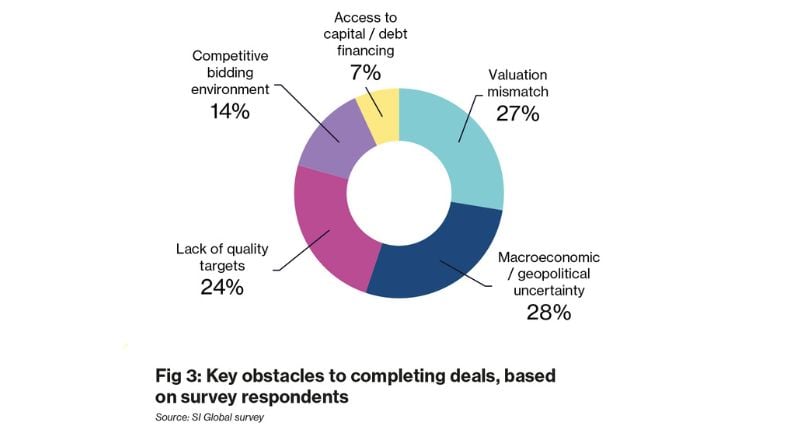

Behind the growing headline numbers is a tougher, more demanding buyer market.

Chin said private equity has become “a programmatic acquirer,” running deeper and more sophisticated due diligence processes.

Founders need specialist advisers, not generalists. “A good accountant is not an M&A finance specialist,” he said, and legal advice alone can’t determine whether “the deal structure or price is fair.”

One major obstacle remains the valuation gap. Chin said many sellers are still anchored to “the peak multiples of 2021 and 2022 rather than the reality of their recent twelve-month performance.”

Vargiu warned the divide between top-performing assets and everyone else is widening. “For the right sellers, it is a sellers’ market,” she said.

“But only if the fundamentals are right.” That includes leadership depth, succession planning, cultural stability and a tight financial story.

Buyers increasingly apply benchmarks such as the 20/20/20 rule: client concentration under 20 per cent of gross profit, 20 per cent year-on-year growth, and 20 per cent EBITDA.

Differentiated capability continues to rise in value, especially digital, B2B, regulatory, cyber, analytics, ecommerce, experiential, influencer and retail media.

Strategic communications is booming too, with Vargiu pointing to escalating demand for reputation and crisis advisory.

Her message for founders heading into the next deal cycle is blunt: “readiness wins.”