• Easter affects April ad spend, but market remains at record high FYTD

• Outdoor, radio and cinema climb, newspapers and magazines tumble

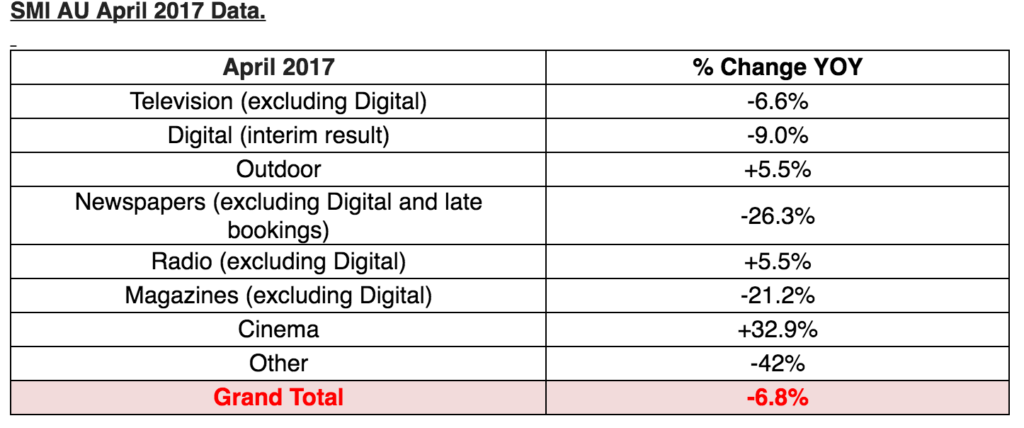

Australia’s media agency market is so far reporting a 6.8% decline in advertising expenditure in April 2017 to $501.9 million, mostly due to the Easter holiday period falling in the month and lower Government ad spend compared to last year’s pre-election highs, reports SMI.

Late digital bookings are expected to reduce the level of decline when added at the end of the month, but for now the interim digital result is showing a decline of 9.5%. For the calendar year-to-date period digital ad spend is now 1.9% ahead of the previous calendar year period.

So far this month outdoor media is reporting the best growth, with total agency bookings up 5.5% to a record April level of $63.0 million. Radio also grew by the same amount (+5.5%) to a record April result of $43.4 million. And the smallest media of cinema recorded the highest percentage growth for the month (+32.9%).

SMI Australia and New Zealand managing director Jane Schulze said it was inevitable the market would fall in April 2017 given there was no Easter period in April 2016.

“Timing issues are hugely significant when comparing like-for-like data, and the occurrence of Easter is always a key issue,’’ she said.

“However, SMI’s longer-term data shows the market remains very stable, with ad spend over the calendar year essentially flat, at -0.6%, and actually higher over the financial year-to-date period. Indeed, in that eight-month period the ad market is at a record high, up 0.4%.’’

Agency demand in April 2017 was also dented by a large decline in Government category ad spend from last year’s Federal Election-inspired highs with the total back 26.7% this month.

However, the largest dollar decline was actually recorded by the food/produce/dairy category, where ad spend fell $9.1 million from April 2016, with the media of TV, outdoor and digital most affected.

And for digital media, this month SMI launched four new food/produce/dairy sub categories to provide even more insight into the areas most reducing digital spend. Similarly, for the first time this month SMI’s in-home entertainment category has been split to show ad spend for home entertainment (film), home entertainment (TV), gaming, music and books.

Among the major product categories, the strongest demand in April came from the retail market where ad spend has already grown 25.3% to $45.8 million.

The largest category of automotive brand also maintained its strong growth with total bookings lifting 5.4% YOY.